Bitcoin 2015: What’s in store?

Updated on 05 April 2024

2014 was a very interesting year for Bitcoin: even though its price dropped 67%, there were major moves in terms of trade, transactions, and capital investments. Big brand names like Microsoft, Dell, Expedia, Dell, NewEgg, and Overstock started to accept Bitcoin payments.

This January, CoinDesk published its State of Bitcoin 2015 report, a 2014 Year in Review and a fourth-quarter analysis of price and valuation, media, VC Investment, Commerce, Technology and Regulation.

Volatility is one of the major criticisms of this cryptocurrency. The Mt Gox bankruptcy in 2014, when the price dropped from $951.39 to $309.87, was the starting point for a decrease that plunged further in January 2015 by another 18%.

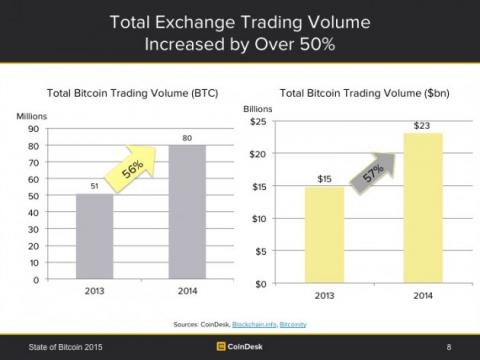

But, despite this price decrease, people have started to trust Bitcoin, evidenced by their increasing use of the cryptocurrency. At the beginning of 2014, Bitcoin’s training volume increased by more than 50% and in the fourth quarter of 2014, the number of daily transactions passed the 100 000 mark.

Venture capitalists invested $335 million in new Bitcoin start-ups in 2014 and the number of countries that received VC investment grew from 8 to 18 in the same year, half of these are located in Europe (Netherlands, Denmark, Luxemburg, Sweden, and Germany) who joined alongside Japan, Panama, India, Mexico, and Argentina.

Even though in the last quarter of 2014 the number of new merchants accepting Bitcoin slowed, CoinDesk estimated an increase in 2015 to over 140 000 merchants and a growth to 12 million Bitcoin wallets by the end of 2015.

Government regulation is still the key to Bitcoin attracting more users in 2015. States around the world are currently considering its regulation. This will not only increase consumer confidence in the technology, it will also involve more companies and investors in the Bitcoin business. As CoinDesk showed in its report, Africa is the only region where Bitcoin hasn’t received much regulatory attention as yet.

So, for the future, Bitcoin will do one of two things: become a strong currency in digital transactions or become a historical curiosity. Its future will largely depend on the measures taken by governments. ‘We’ll also see additional regulation in 2015’, Zennon Kapron, managing director of Shanghai-based market research firm KapronAsia told CNBC. ‘Many countries have yet to take a stance on Bitcoin and digital currencies or haven’t completely promulgated their rules. Regulation itself will not stop Bitcoin’, Kapron said, ‘but it could slow it enough that people lose interest or it is replaced with something else.’

Let’s follow its next steps.

Related blogs

Related events

Subscribe to Diplo's Blog

The latest from Diplo and GIP

Tailor your subscription to your interests, from updates on the dynamic world of digital diplomacy to the latest trends in AI.

Subscribe to more Diplo and Geneva Internet Platform newsletters!

Diplo: Effective and inclusive diplomacy

Diplo is a non-profit foundation established by the governments of Malta and Switzerland. Diplo works to increase the role of small and developing states, and to improve global governance and international policy development.